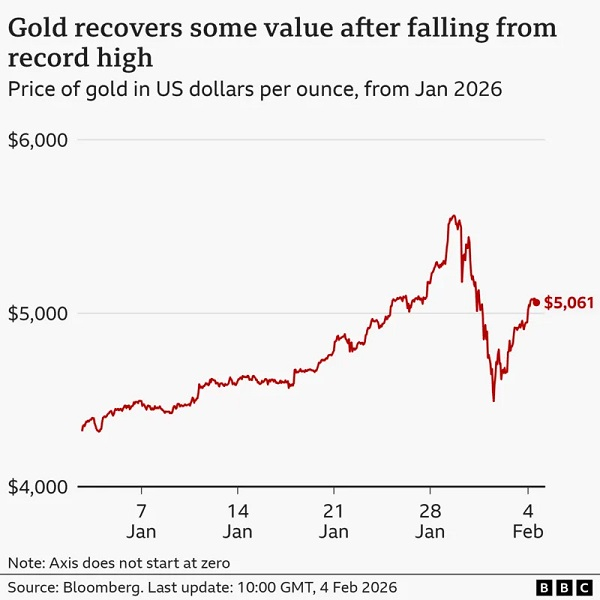

Bullion — widely seen as a hedge during uncertain times — climbed back above $5,000 after a volatile stretch that saw prices tumble sharply and then surge again. Markets are now bracing for elevated volatility, with tensions in the Middle East and big bank forecasts pushing some analysts to eye even higher targets later this year.

WHAT’S DrivinG The Rally:

- Safe‑haven buying after military incident: The U.S. downing of the Iranian drone has reignited fears of escalation, boosting demand for gold as a risk hedge.

- Central banks still buying bullion: Ongoing purchases by global central banks have kept structural support under gold prices despite earlier sell‑offs.

- Market whipsaw: Gold has swung wildly — from record highs near $5,600 to a steep fall below $4,500 before snapping back above $5,000 this week.

MARKET OUTLOOK:

Strategists warn that persistent geopolitical risk and shifting monetary policy expectations mean gold could remain on edge — potentially heading toward fresh multi‑year highs if safe‑haven demand intensifies further.