Government statistics may say inflation has slowed to 3.8%, but for millions of Ghanaians, the cost of living still feels painfully high. So why does the official data suggest progress while wallets remain under siege? The answer lies in the fine print behind the numbers.

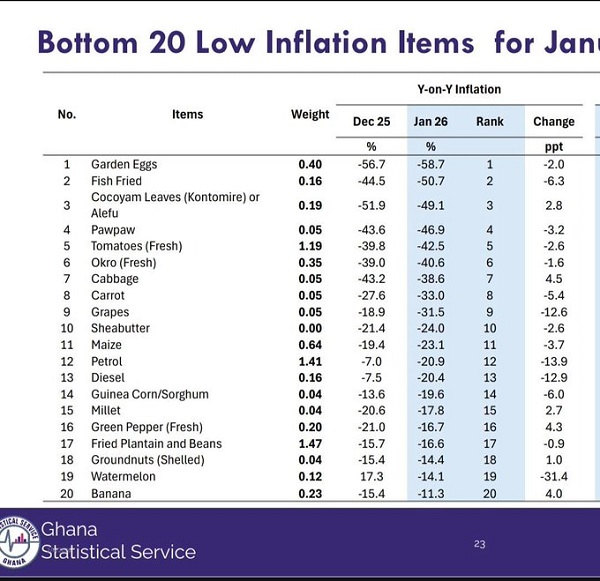

Economists explain that inflation measures the rate of increase in prices—not whether prices are actually coming down. In simple terms, things are still expensive; they’re just becoming expensive at a slightly slower pace. For consumers already stretched thin by months of price hikes, that difference offers little comfort at the market or fuel station.

Another key factor is income stagnation. While inflation may ease on paper, salaries and wages have failed to catch up, meaning purchasing power remains weak. Essentials like food, transport, utilities, and rent—items that hit ordinary people the hardest—continue to dominate household spending, making the so-called inflation relief feel invisible.

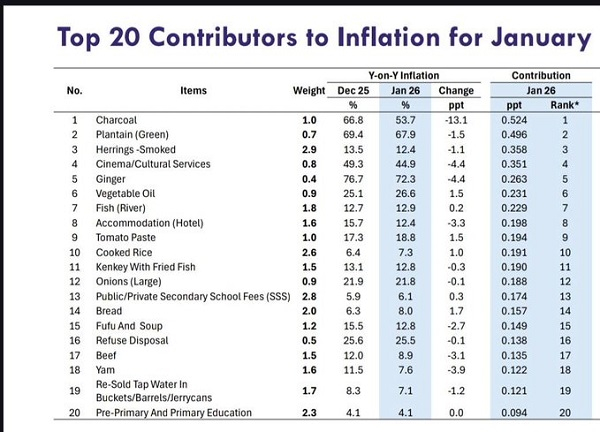

Critics also point to how inflation is calculated, arguing that the official basket of goods doesn’t fully reflect the daily realities of the average Ghanaian. When tomatoes, rice, fuel, and school fees keep rising, no statistic can convince consumers that things are truly improving.

So while 3.8% inflation may look good in economic reports and press briefings, the real economy—the one lived in markets, shops, and homes—tells a very different story. Until prices fall or incomes rise meaningfully, Ghanaians will keep asking the same question: If inflation is down, why does life still feel so expensive?