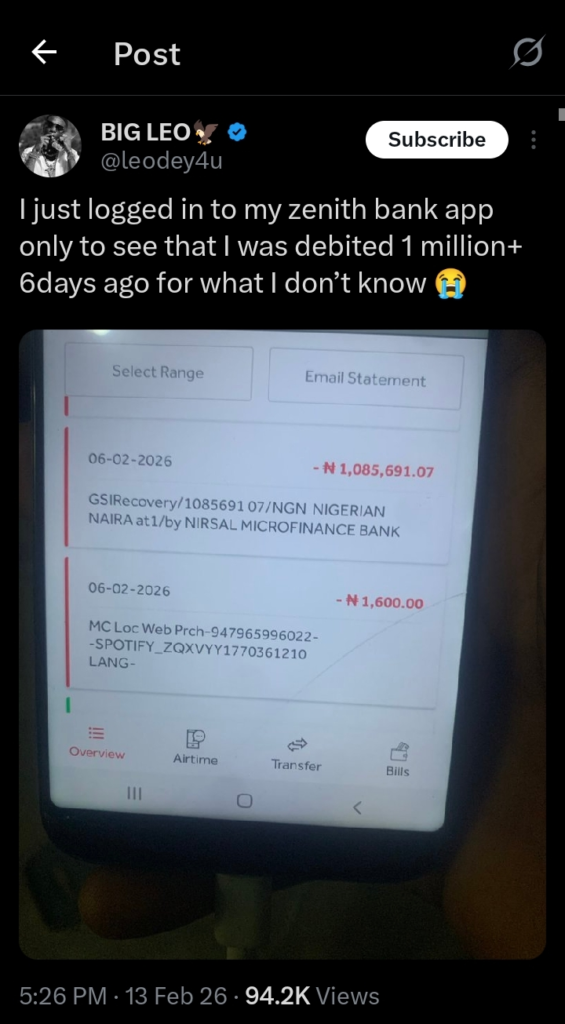

LAGOS — Outrage is building after a visibly distressed customer cried out online, claiming that ₦1 million vanished from his account at Zenith Bank — and insisting it’s “not the first time.”

In a now-viral complaint, the man alleged that the massive deduction hit without prior notice, leaving him shocked and scrambling for answers.

“This Keeps Happening!”

According to the customer, the unexpected debit has occurred before — raising serious concerns about account security and transaction transparency.

“Not the first time!” he reportedly lamented, demanding immediate clarification and reversal.

The claim quickly ignited heated reactions across social media, with many users sharing their own banking horror stories, while others urged caution and advised verifying transaction details.

Questions Mount

As of the time of reporting, there has been no official public statement addressing this specific allegation. Banking experts note that large deductions can sometimes be linked to:

- Failed transaction reversals

- Loan or overdraft recoveries

- Standing orders or mandates

- Fraud investigations or chargebacks

However, without a formal explanation from the bank or documented evidence, the full picture remains unclear.

Social Media Reacts

The incident has fueled broader conversations about:

- Digital banking reliability

- Customer complaint resolution speed

- Transparency in automated deductions

Many are calling for stronger communication channels between financial institutions and their customers to prevent panic when large sums are involved.

What Customers Should Do

If you notice unexpected deductions:

- Immediately contact your bank through official channels.

- Request a detailed transaction statement.

- File a formal complaint and keep reference numbers.

- Escalate through regulatory bodies if unresolved.